SOCR Data MonetaryBaseStocksInterest1959 2009

Contents

SOCR Data - US Federal Reserve Monetary-Base Data (1959-2009)

Data Description

- Source: Federal Reserve Bank of St. Louis.

- Definitions:

- Rows: Monthly data: 01/01/1959 - 10/01/2009 (Format: YYYY-MM-DD)

- Columns and rows in this table include (Monthly data in Billions of Dollars):

- SAVINGSL: The savings deposits component of M2 consists of passbook-type savings deposits as well as MMDAs at banks and thrifts. This item is reported on the FR 2900 and, for institutions that do not file the FR 2900, is estimated using data reported on the Call Reports.

- M2SL: M2 includes a broader set of financial assets held principally by households. M2 consists of M1 plus: (1) savings deposits (which include money market deposit accounts, or MMDAs); (2) small-denomination time deposits (time deposits in amounts of less than 100,000USD); and (3) balances in retail money market mutual funds (MMMFs). Seasonally adjusted M2 is computed by summing savings deposits, small-denomination time deposits, and retail MMMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1.

- M1NS: Ml includes funds that are readily accessible for spending. M1 consists of: (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) traveler's checks of nonbank issuers; (3) demand deposits; and (4) other checkable deposits (OCDs), which consist primarily of negotiable order of withdrawal (NOW) accounts at depository institutions and credit union share draft accounts.

- BOGAMBSL: Board of Governors Monetary Base, Adjusted for Changes in Reserve Requirements.

- TRARR: Board of Governors Total Reserves, Adjusted for Changes in Reserve Requirements.

- BORROW: Total Borrowings of Depository Institutions from the Federal Reserve.

- CURRCIR: Currency in Circulation.

- PercentDeficit: Percent Federal Budget Deficit

- Unemployment and Inflation Data from Bureau of Labor Statistics

- Unemployment: Average monthly unemployment

- Inflation: Average monthly inflation

- Stock Market Data from Irrational Exuberance, Princeton University Press, 2005, by Robert J. Shiller

- SP_Comp_Index: S&P Composite Index

- Dividend: Average dividend

- Earnings: Average earnings

- CPI: Consumer Price Index

- HPI: House Price Index, a measure of the movement of single-family house prices in the U.S. which serves as an indicator of house price trends and provides an analytical tool for estimating changes in the rates of mortgage defaults, prepayments, and housing affordability. The HPI is published by the Federal Housing Finance Agency (FHFA) using data supplied by various home lenders. The raw HPI data were provided on quarterly basis and were interpolated on a monthly basis for the same time period (1959-2009). This is the real (inflation adjusted, Case-Shiller, US national) HPI index and it is relative to 1890, when the default HPI=100. The HPI tracks 20 individual metropolitan areas and the index is calculated monthly by following repeat sales of the same single-family homes over time.

- InterestRate: Long Interest Rate

- RealPrice: average Real stock price

- RealDividend: real Average dividend

- RealEarnings: real Average earnings

- PriceEarningsRatio: Average Price per Earnings Ratio (P/E)

Revision 1: Data Expansion (2009-2019)

In *December 2019*, HS650 DSPA Students (Ziyuan Sun, Xiaochuan Guo, and Jiawei Zhang) appended the data by including information over the last decade (2009-2019).

- Notes: Some specific notes comparing to the original (1559-2009) dataset to the revised data:

- Variable BOGAMSL was replaced by AMBSL, as the Federal Reserve no longer updates BOGABMSL, since July 11, 2013.

- Variable TRARR was replaced by TOTRESNS, as the Federal Reserve no longer updates data BOGABMSL, since July 11, 2013.

- Past data for variables RealPrice, RealDivident and RealEaning were slightly changed reflecting new sources of data Stock Market Data Used in "Irrational Exuberance" Princeton University Press, updated in 2015.

Below are the data descriptions and additional sources of data:

- Source: Irrational Exuberance, Princeton University Press, 2005, by Robert J. Shiller

- SP_Comp_Index: The S&P 500, or just the S&P, is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. To calculate the value of the S&P 500 Index, the sum of the adjusted market capitalization of all 500 stocks is divided by a factor, usually referred to as the Divisor. (According Wikipedia: https://en.wikipedia.org/wiki/S%26P_500_Index)

- RealPrice: average Real stock price

- RealDividend: real Average dividend

- RealEarnings: real Average earnings

- PriceEarningsRatio: Average Price per Earnings Ratio (P/E)

- Dividend: Average dividend

- Earnings: Average Earnings

- InterestRate: Long Interest Rate

- CPI: A Consumer Price Index measures changes in the price level of a weighted average market basket of consumer goods and services purchased by households.

- HPI: House Price Index, a measure of the movement of single-family house prices in the U.S. which serves as an indicator of house price trends and provides an analytical tool for estimating changes in the rates of mortgage defaults, prepayments, and housing affordability. The HPI is published by the Federal Housing Finance Agency (FHFA) using data supplied by various home lenders. The raw HPI data were provided on quarterly basis and were interpolated on a monthly basis for the same time period (1959-2019). This is the real (inflation adjusted, Case-Shiller, US national) HPI index and it is relative to 1890, when the default HPI=100. The HPI tracks 20 individual metropolitan areas and the index is calculated monthly by following repeat sales of the same single-family homes over time.

- Source: Reserve Bank of St. Louis

- SAVINGSL: Savings Deposits - Total. The savings deposits component of M2 consists of passbook-type savings deposits as well as MMDAs at banks and thrifts. This item is reported on the FR 2900 and, for institutions that do not file the FR 2900, is estimated using data reported on the Call Reports.

- M1NS: M1 includes funds that are readily accessible for spending. M1 consists of: (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) traveler’s checks of nonbank issuers; (3) demand deposits; and (4) other checkable deposits (OCDs), which consist primarily of negotiable order of withdrawal (NOW) accounts at depository institutions and credit union share draft accounts.

- M2SL: M2 includes a broader set of financial assets held principally by households. M2 consists of M1 plus: (1) savings deposits (which include money market deposit accounts, or MMDAs); (2) small-denomination time deposits (time deposits in amounts of less than $100,000); and (3) balances in retail money market mutual funds (MMMFs). Seasonally adjusted M2 is computed by summing savings deposits, small-denomination time deposits, and retail MMMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1.

- AMBSL: St. Louis Adjusted Monetary Base

- TOTRESNS: Total reserves of depository institutions. This series is a sum of total reserve balances maintained plus vault cash used to satisfy required reserves.

- BORROW: Total Borrowings of Depository Institutions from the Federal Reserve. Please note breaks in data: Data prior to 2003-01-01 include adjustment, extended, and seasonal credit. Data from 2003-01-01 to 2007-11-01 include primary, secondary, and seasonal credit. Data from 2007-12-01 to 2008-02-01 include primary, secondary, seasonal, and term auction credit. Data from 2008-03-01 forward include primary, secondary, seasonal credit, primary dealer credit facility, other credit extensions, and term auction credit. Data from 2008-09-01 are loans to depository institutions for primary, secondary, and seasonal credit, primary dealer and other broker-dealer credit. This category also includes the asset-backed commercial paper money market mutual fund liquidity facility, other credit extensions, and term auction credit.

- CURRCIR: Currency in Circulation. Data prior to 1991 are from various issues of Banking and Monetary Statistics and the Annual Statistical Digest. Data from 1991 forward are calculated using data from the H.4.1 Release - Factors Affecting Reserve Balances. As of March 1, 2019, this series is calculated as a monthly average of WCURCIR.

- Source: White House office of management and budget

- PercentDeficit: Percent Federal Budget Deficit

- Source: Bureau of Labor Statistics

- Unemployment: Average monthly unemployment rate

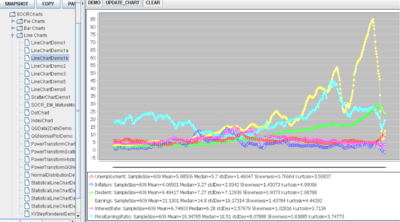

Charts and analyses

The following SOCR resources may be useful for visualization, analysis and exploration of these data.

- SOCR Interactive Motion Chart.

- Bubble Chart Activity and Bubble-Chart-Demo1 Applet.

- SOCR Multiple Linear Regression Applet.